Deriv traders, particularly those who focus on trading Volatility Indices such as V75, V10, and V25, can significantly improve their technical analysis and overall trading strategies by utilizing specific, top-performing TradingView indicators. These carefully designed indicators are crafted to effectively capture the unique price movements and volatility characteristics inherent to Deriv’s synthetic indices.

By doing so, they offer highly valuable insights that significantly assist scalpers, intraday traders, and strategy developers in making much more well-informed and timely decisions regarding their entry and exit points in the market. These insights help enhance their overall trading performance and improve the accuracy of their trades.

Additionally, by leveraging the most appropriate and effective set of indicators available on TradingView and integrating them seamlessly with Deriv’s trading platforms, including MT5, Deriv X, or cTrader, traders can enhance their accuracy and boost their performance in these fast-paced, algorithmically driven market environments.

Understanding Deriv Volatility Indices and Technical Analysis

Deriv Volatility Indices simulate real market volatility by creating a synthetic, algorithm-driven environment that operates continuously around the clock, 24 hours a day, 7 days a week, without being influenced or disrupted by external news events or economic announcements.

These indices replicate various levels of market volatility, ranging from low volatility scenarios to highly aggressive, volatile conditions (for example, from Volatility 10 to Volatility 75). They achieve this by utilizing sophisticated probabilistic models designed to generate realistic price movements and fluctuations.

This unique setup provides technical traders with a focused trading environment where they can concentrate exclusively on price action, momentum, and volatility patterns without having to worry about unpredictable economic news or external market noise.

As a result, these indices are particularly well-suited for traders who rely heavily on technical analysis strategies and prefer a clean, noise-free market simulation to refine their trading techniques. Technically, analysis of Deriv’s Volatility Indices is centered on momentum indicators, trend-following tools, and volatility measures.

Because the indices are synthetic and based on algorithmic price generation with high tick frequency (some with one-second updates), traders often must adjust traditional indicator settings on TradingView to shorter periods for responsiveness and precision.

This ensures the indicators capture fast market moves and volatility spikes common to indices like V75 or V100. Customizing these tools becomes essential to detect trend shifts, entry/exit points, and volatility regimes accurately in such high-speed environments.

Key aspects that are crucial for technical traders to consider include:

- Understanding volatility levels is essential for effectively tailoring trading strategies to match the index’s moving speed and overall risk profile. For example, traders might adopt scalping techniques specifically on high-volatility indices such as V75, where rapid price fluctuations create multiple short-term profit opportunities. By closely analyzing these volatility patterns, traders can optimize their approach to better align with market dynamics, manage risk more effectively, and improve their chances of success.

- Using momentum oscillators, such as the Relative Strength Index (RSI) or the Stochastic Oscillator, on lower timeframes and with shorter periods can effectively capture and reflect rapid price changes in the market. These indicators, when adjusted to shorter intervals, provide more sensitive and timely signals that help traders quickly identify shifts in momentum and potential reversal points. By focusing on condensed timeframes, traders can better respond to fast-moving market conditions and make more informed decisions based on the accelerated feedback these oscillators provide. This approach is particularly useful for day trading or scalping strategies where quick reactions to price changes are essential.

- Combining popular trend indicators, such as the Exponential Moving Average (EMA) or the Ichimoku Cloud, along with volatility-focused metrics like the Average True Range (ATR) and Bollinger Bands, can provide a comprehensive approach to analyzing market behavior. This method helps traders better gauge not only the strength and direction of a prevailing trend but also the expansions or contractions in market volatility, allowing for more informed and strategic trading decisions.

- Setting dynamic stop-losses and profit targets based on real-time volatility readings derived from indicators such as the Average True Range (ATR) or Donchian Channels enables traders to manage risk more effectively and adapt to changing market conditions. By adjusting these levels dynamically in response to market volatility, traders can better protect their capital and optimize potential returns more systematically and responsively.

- Taking full advantage of TradingView’s seamless integration with Deriv platforms allows users to access real-time charting features and extensive indicator customization options. This integration also supports Pine Script automation, enabling the creation and deployment of sophisticated trading bots and expert advisors to enhance trading strategies effectively.

Deriv Volatility Indices provide a carefully controlled, technology-driven market environment that serves as an ideal playground for traders who possess strong skills in technical analysis and seek fast, reliable, and highly adaptive indicators specifically designed for synthetic volatility.

Developing a deep mastery of these sophisticated indicators, along with their customizable settings available on platforms like TradingView, greatly improves a trader’s capability to effectively navigate, understand, and ultimately profit from the distinctive and often complex characteristics inherent in these synthetic volatility markets.

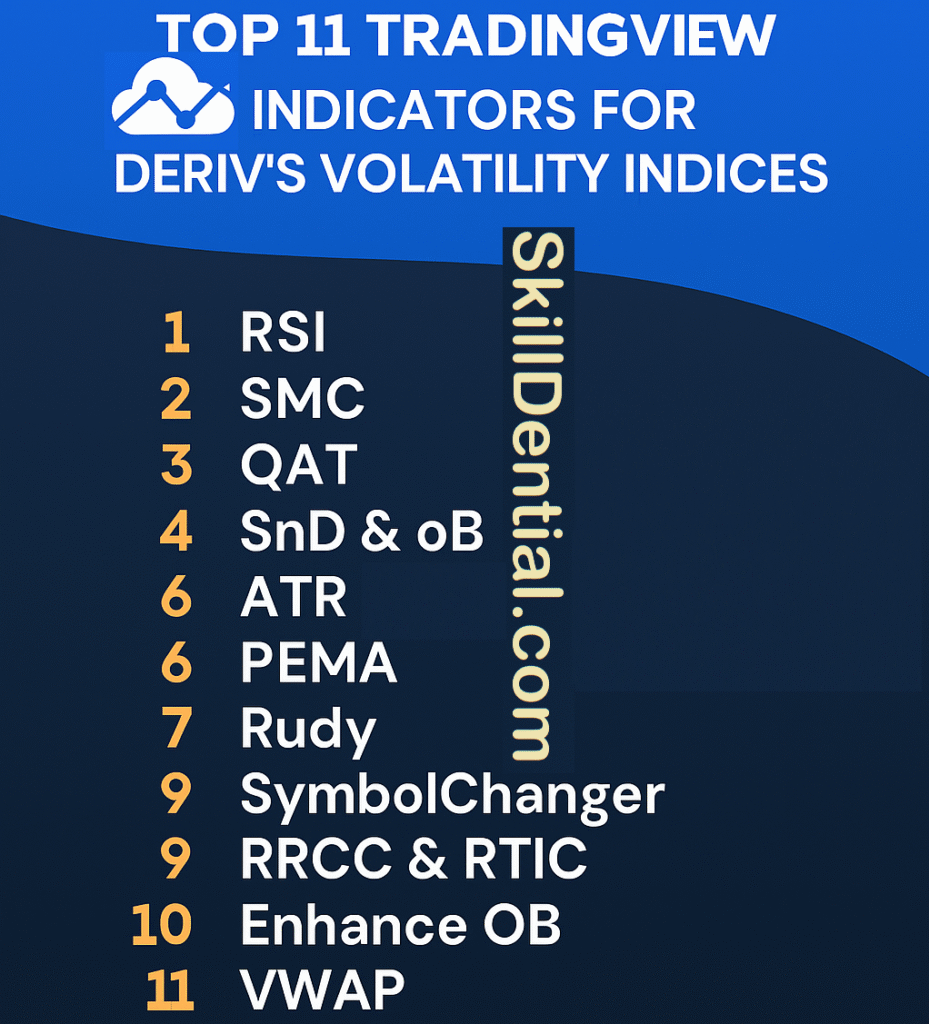

Top TradingView Indicators for Deriv’s Volatility Indices

Deriv’s Volatility Indices provide a distinctive and innovative synthetic market environment that features uninterrupted 24/7 trading, with options for fixed or dynamically varying volatility levels. The price movements within this market are driven entirely by sophisticated algorithms, making them independent and unaffected by any real-world economic events or factors.

Using TradingView indicators that are specifically designed and optimized for this unique setting enables traders to effectively identify and capture momentum shifts, trend reversals, and changes in volatility.

Below, we present the top 11 highly recommended indicators that are particularly well-suited for trading Deriv’s Volatility Indices, including popular assets like V75, V10, and V25, accompanied by practical insights and detailed guidance on how to set up and make the most of these tools in your trading strategy.

Exponential Moving Average (EMA) 50

The EMA 50 is a fundamental trend-following indicator widely used by traders as a dynamic level of support or resistance in the market. Many traders closely monitor price movements in relation to the EMA 50, as well as shorter-term EMAs such as the EMA 21, to help them time their entry and exit points more effectively.

In particularly fast-moving and highly volatile indices such as V75, the EMA 50 consistently proves to be an exceptionally reliable and effective tool for confirming shifts in momentum. This reliability allows traders to respond with greater confidence and precision to rapid and significant price fluctuations, helping them make well-informed decisions in dynamic market conditions.

Moving Average Convergence Divergence (MACD)

The MACD indicator highlights momentum shifts by carefully analyzing the convergence and divergence of exponential moving averages (EMAs) over time. By customizing the MACD to use shorter periods, traders can significantly improve its responsiveness to rapid price changes.

This enhanced sensitivity is especially essential when trading synthetic indices, where price action tends to accelerate quickly and unpredictably. Overall, this powerful indicator serves to signal potential trend reversals early or to confirm the strength and continuation of existing trends, providing valuable insights for timely decision-making in fast-moving markets.

Relative Strength Index (RSI)

RSI signals indicate whether a market is overbought or oversold, providing valuable insight into potential price movements. By using a lower period RSI, such as 7 or 9, traders can achieve higher sensitivity to rapid price fluctuations, which are common in Deriv’s indices.

This heightened sensitivity significantly improves the ability to more precisely identify short-term correction points or potential market reversals. As a result, traders are better equipped to make timely, well-informed decisions, even in a rapidly changing and fast-moving market environment where every moment counts and swift action can be crucial for success.

Average True Range (ATR)

ATR measures market volatility by calculating the average range of price movements over a specified period of time. This indicator’s readings adjust stop-loss and take-profit levels dynamically according to the current market volatility, allowing traders to better manage their risk in response to changing market conditions.

By continuously adapting to the ever-changing and constantly fluctuating nature of the Volatility Indices markets, ATR plays a crucial role in helping traders and investors optimize their risk management strategies more effectively and efficiently. This adaptability allows for better anticipation of market movements and adjustments to risk exposure, leading to improved decision-making and enhanced overall performance in volatile market conditions.

Bollinger Bands

Bollinger Bands are a technical analysis tool that plot volatility-based envelopes around a moving average, providing a clear visual representation of periods of market contraction and expansion. These bands adjust dynamically based on the changing volatility of the underlying asset.

For indices characterized by lower volatility, such as V10 or V25, Bollinger Bands are especially useful as they help traders identify potential upcoming breakouts or pullbacks. This is achieved by highlighting moments when the bands squeeze tightly together or stretch apart, signaling shifts in market momentum and potential trading opportunities.

Volume Profile

Although volume behaves differently in synthetic markets compared to traditional markets, the Volume Profile tool effectively displays trading activity by specific price zones. This visualization helps traders identify crucial support and resistance levels by highlighting areas where the price tends to consolidate or where it reacts strongly.

By carefully analyzing these specific price zones, traders are able to gain valuable and deeper insights into overall market behavior as well as identify potential turning points that could significantly impact their trading decisions.

SuperTrend Indicator

By combining the Average True Range (ATR) with price direction, SuperTrend provides clear and actionable buy or sell signals. This approach is particularly effective for scalpers who aim to capitalize on quick price movements in Volatility Indices.

The indicator is designed to assist traders in identifying and securing early entry points more accurately, allowing them to capitalize on potential market movements from the outset. Additionally, it provides valuable tools for effectively managing trailing stop-losses, which helps in protecting profits while minimizing losses.

By integrating these features, the indicator significantly enhances the overall trading strategy and improves risk management, enabling traders to make more informed and confident decisions in various market conditions.

Ichimoku Cloud

This highly comprehensive indicator effectively displays trend momentum, key support and resistance levels, as well as clear buy and sell signals across multiple timeframes. Its sophisticated multi-layered structure makes it particularly suitable for analyzing longer-term trend contexts in greater depth.

Additionally, it provides traders with the valuable ability to cross-verify signals by using it alongside other technical indicators, which significantly enhances the overall accuracy of their decision-making process and boosts their confidence in executing trades.

This integrated and comprehensive approach plays a crucial role in significantly assisting traders by enabling them to make more informed, well-rounded, and reliable trading decisions. It provides them with a deeper understanding and greater insight, which ultimately leads to increased confidence and improved accuracy in their trading activities.

Stochastic Oscillator

This momentum tool has been specifically designed to rapidly detect overbought and oversold phases within the market, making it an exceptionally valuable resource for accurately identifying short-term reversals and pinpointing optimal entry points for trades.

Its effectiveness is especially pronounced on low timeframes, which are frequently utilized in synthetic index trading, thereby enabling traders to make well-timed and highly informed decisions in fast-moving and often volatile market conditions where quick reactions are crucial.

Donchian Channels

Donchian Channels highlight the highest highs and lowest lows recorded over a selected period of time, providing a clear visual representation of price volatility within that timeframe. They are particularly useful for traders and analysts in identifying significant breakouts and potential trend continuations, especially in market environments characterized by volatility-driven price spikes.

By effectively capturing and highlighting these crucial key price levels, Donchian Channels assist market participants in making significantly more informed and strategic decisions that are based on the most recent and relevant price extremes observed in the market.

Chaikin Volatility Indicator

By carefully measuring the spread between the highest and lowest prices within a given period, this indicator is able to effectively identify significant shifts in market volatility. It also helps detect potential price reversals or momentum continuations, providing valuable insights for traders.

This capability allows them to more accurately and strategically time their entry and exit points when navigating the often unpredictable and fluctuating synthetic markets, which ultimately leads to a significant improvement in their overall decision-making process within fast-paced and dynamic trading environments.

Practical Setup Tips for TradingView with Deriv Volatility Indices

- Choose lower timeframe charts such as 1-minute and 5-minute intervals to effectively capture and analyze the rapid and often unpredictable price movements that are characteristic of these indices in the market. These shorter timeframes provide more detailed insights into the quick fluctuations, allowing for better-informed trading decisions.

- Adjust the default periods of momentum indicators such as RSI and MACD to shorter lengths in order to minimize lag and improve responsiveness. By reducing these periods, the indicators can react more quickly to recent price changes, providing more timely signals for trading decisions. This adjustment helps traders capture momentum shifts earlier and adapt more swiftly to market movements.

- Use ATR or Donchian Channels to establish adaptive stop levels, effectively reducing the risk of whipsaw movements. These dynamic stops adjust according to market volatility, providing a more responsive and flexible approach to managing trades and protecting capital from sudden price fluctuations.

- Combine trend, momentum, and volatility indicators to effectively filter trading signals and confidently confirm trades. By integrating these indicators, you can enhance your trading strategy, ensuring that signals are more reliable and trades are executed with greater precision and reduced risk. This comprehensive approach allows you to better analyze market conditions, identify strong entry and exit points, and improve overall trading performance.

- Use TradingView’s powerful alert system combined with the flexibility of Pine Script to fully automate your signal notifications, ensuring you never miss a trading opportunity. Additionally, you can develop and implement custom trading strategies that are fully compatible with Deriv’s bot and Expert Advisor platforms, allowing for seamless integration and enhanced trading automation. This approach enables traders to optimize their trading workflow by leveraging automated alerts and tailored strategies designed specifically for Deriv’s sophisticated trading environment.

Why These Indicators Work for Deriv Volatility Indices

Deriv’s unique synthetic indices create their price movements entirely internally, featuring built-in volatility profiles that do not depend on external market events or traditional economic factors.

Therefore, the most effective TradingView indicators for trading these synthetic markets must be specifically designed to adapt quickly to rapid, algorithmic price swings rather than relying on conventional fundamental analysis. Indicators that emphasize volatility measurement, momentum stability, and dynamic trend assessment tend to perform exceptionally well in this environment.

Tools such as Exponential Moving Averages (EMAs) and SuperTrend indicators provide clear insights into trend direction, while the Average True Range (ATR) and Bollinger Bands are valuable for measuring the evolving volatility levels, which is crucial for effective risk management when trading these synthetic instruments.

In Summary

Mastering these 11 specialized TradingView indicators specifically designed for Deriv’s Volatility Indices provides traders with a comprehensive set of powerful tools needed to confidently navigate and effectively exploit the unique and synthetic market dynamics presented by these indices.

By using precise indicator settings along with a well-balanced combination of trend analysis, momentum tracking, and volatility measurement tools, traders can develop robust and highly profitable trading strategies that are ideally suited for the fast-paced, ever-changing, and distinctive environment of Deriv’s Volatility Indices.

Gaining practical experience through live trading, continuous backtesting of strategies, and consistently fine-tuning and adjusting indicator parameters remain essential components for achieving and sustaining long-term trading success in these markets.

For those seeking deeper expertise and a more comprehensive understanding, exploring a variety of resources such as Deriv’s official academy along with the extensive TradingView Pine Script community can be incredibly beneficial.

These platforms offer advanced custom scripts and innovative strategy ideas that can significantly enhance the sophistication and adaptability of your trading system, allowing you to tailor your approach to evolving market conditions more effectively.

Current Trends and Developments

Current trends in Deriv’s synthetic trading landscape highlight significant advancements in the offerings and tools available to traders. Deriv has introduced new synthetic indices that feature varying volatility profiles along with ultra-fast 1-second tick intervals exclusively available on the cTrader platform.

This ultra-high-frequency data presents lucrative opportunities for scalpers and algorithmic traders who require lightning-fast, highly responsive indicators to capitalize on transient price movements. The ongoing integration of TradingView charts within Deriv’s ecosystem enhances the trader experience by providing seamless technical analysis capabilities combined with direct trading execution.

This integration leverages TradingView’s powerful charting platform, renowned for its flexibility, customizability, and extensive indicator library, thus enabling traders to perform comprehensive analysis and implement strategies without leaving the Deriv platform environment.

Further evolving the technical toolkit, AI and machine learning-enhanced indicators on TradingView are gaining momentum. These tools use advanced algorithms to interpret price data and volatility patterns beyond human capabilities, offering predictive insights and automated decision-making assistance.

By uncovering complex relationships and non-linear price behaviors, AI-driven indicators help traders refine their strategies, reduce false signals, and adapt dynamically to market changes. Together, these developments position Deriv’s synthetic indices trading as a cutting-edge domain where rapid innovation meets sophisticated technology, catering especially to traders focused on technical precision and algorithmic automation.

FAQs

Can I use these indicators on all Deriv platforms?

TradingView charts are completely and seamlessly integrated with Deriv MT5, Deriv X, and Deriv cTrader platforms, allowing you to effortlessly apply and utilize these powerful indicators across all of these trading environments without any compatibility issues. This integration ensures a smooth and efficient trading experience across all Deriv platforms.

Which indicator is best for scalping Volatility Indices?

For rapid scalping on indices such as V75, using a combination of EMA 50, SuperTrend, and ATR indicators proves to be highly effective. This trio offers a comprehensive approach by clearly indicating the trend direction, providing valuable context about market volatility, and delivering timely signals for both entry and exit points, which altogether enhance trading precision and decision-making speed.

How do I set stop losses using these indicators?

Use the ATR indicator to gauge recent market volatility and set stop-loss levels proportionally to avoid premature exits. Alternatively, dynamic levels based on Moving Averages and Donchian Channels can act as support or resistance stops.

Are these indicators effective for automated strategies?

All of these technical indicators can be programmed using TradingView’s Pine Script language to create fully automated trading signals. These custom scripts can then be seamlessly integrated with platforms like Deriv Bot or Expert Advisors, enabling sophisticated algorithmic trading strategies to be executed without manual intervention. This approach allows for enhanced precision and efficiency in trading operations.

Do these indicators guarantee profits on Volatility Indices?

No single trading indicator can ever guarantee consistent profits in the market. Nevertheless, by strategically combining multiple indicators along with implementing strong and effective risk management practices, traders can significantly increase the chances of making profitable trades while simultaneously reducing the potential for large losses. This integrated approach helps create a more balanced and informed trading strategy.

In Conclusion

Mastering the most effective TradingView indicators is essential for trading Deriv’s Volatility Indices with confidence and success. By skillfully combining a range of powerful tools that measure trend, momentum, and volatility—such as the EMA 50, MACD, ATR, and SuperTrend—traders are able to more accurately navigate the uniquely synthetic market environment presented by these indices.

This thoughtfully crafted and carefully considered combination enables traders to achieve significantly improved and more precise timing when making entries and exits in the market, while simultaneously offering more effective and enhanced strategies for managing risk in a comprehensive manner.

Additionally, continually adjusting and seamlessly integrating these indicators within Deriv’s ever-evolving ecosystem—which now includes ultra-fast tick indices and cutting-edge AI-driven analytics—gives both scalpers and strategy developers the critical edge needed to capitalize on market volatility with significantly greater precision, control, and confidence over time.

Discover more from SkillDential

Subscribe to get the latest posts sent to your email.