AI trading platforms leverage machine learning—specifically, deep neural networks and reinforcement learning—to automate market analysis and trade execution. In 2026, the sector has transitioned from simple rule-based automation to agentic systems capable of processing vast, multi-modal datasets across equities and digital assets.

While legacy tools like Trade Ideas (stocks) and 3Commas (crypto) remain industry staples, hybrid platforms such as AlgosOne now offer cross-market liquidity management. As these systems move into mission-critical workflows, users must prioritize institutional-grade security and rigorous compliance with SEC algorithmic mandates and the EU AI Act’s transparency requirements for high-risk financial models.

Performance Benchmarks: What Defines a “Top” Platform?

In 2026, the delta between a standard retail tool and a top-tier AI Trading Platform is defined by agentic intelligence. Industry leaders have moved beyond static “If-Then” logic to autonomous systems that reason through multi-modal datasets. To maintain a competitive edge, a platform must excel in four technical dimensions:

Agentic Autonomy and Long-Horizon Planning

Top platforms use Agentic AI to manage the complete trade lifecycle without constant human oversight.

- The “Retail Quant” Advantage: These agents can set long-term goals, track progress, and self-correct based on trial-and-error (Reinforcement Learning).

- Proactive Response: Unlike reactive bots, agentic systems proactively search for external triggers—such as a sudden spike in network gas fees or a macro-policy shift—and adjust position sizes before a price trend fully materializes.

Multi-Modal Data Normalization

The primary differentiator for 2026 hybrid tools like Tickeron or AlgosOne is their ability to normalize disparate data streams into a single “Confidence Score.”

- Fundamental & Macro Integration: AI models ingest traditional data—SEC filings, interest rate yield curves, and corporate earnings—to establish a baseline “Intrinsic Value.”

- On-Chain & Sentiment Layering: Simultaneously, the system processes real-time blockchain telemetry (whale wallet movements, exchange outflows) and social media narrative persistence.

- Normalization at the Source: Advanced architectures now use dedicated layers (like the UNITY unified data model) to standardize these varied formats, preventing “model hallucination” caused by dirty or fragmented data.

Execution Speed and Latency Infrastructure

In algorithmic trading, speed is a survival requirement, not just an optimization.

- Predictive Routing: Top platforms use AI to anticipate liquidity “thin zones” and route orders across multiple venues (CEX and DEX) to minimize slippage.

- Near-Instant Finality: Systems integrated with high-performance chains (like Solana) or institutional FIX protocols ensure that the gap between a signal and its execution is measured in microseconds.

Regulatory Integrity and “Explainability”

Under the 2026 EU AI Act and updated SEC mandates, top platforms must provide “Explainable AI” (XAI).

- Audit Trails: Every trade must have a “logic trail” that identifies which data inputs triggered the action.

- Risk Controls: Automated safeguards—such as correlation analysis to prevent overexposure to related assets—are built directly into the model’s weights rather than added as an afterthought.

Analysis: Traditional vs. Agentic Platform Capabilities

| Capability | Legacy Rule-Based Bot | 2026 Agentic AI Platform |

| Data Ingestion | Single-stream (OHLCV) | Multi-modal (News, On-chain, Macro) |

| Logic Type | Reactive (If RSI > 70) | Proactive (Goal-driven reasoning) |

| Market Adaptation | Requires manual recalibration | Self-improving feedback loops |

| Compliance | User-dependent | Built-in XAI and Audit Trails |

Stock AI vs. Crypto AI: Comparative Technical Frameworks

While both systems fall under the umbrella of an AI Trading Platform, their internal architectures are optimized for vastly different data environments. Stock AI is engineered for deep fundamental integration and micro-millisecond execution, whereas Crypto AI is built for 24/7 on-chain adaptability and multi-venue liquidity.

Data Processing and Signal Generation

The inputs required to achieve alpha in equities are fundamentally different from those in digital assets.

- Stock AI Systems: These prioritize structured data and “alternative” corporate insights. Top-tier platforms ingest SEC EDGAR filings (10-K, 10-Q), earnings call transcripts (via NLP), and macroeconomic indicators such as CPI and interest rate yield curves. The goal is to identify a “valuation gap” based on intrinsic company health.

- Crypto AI Systems: These focus on unstructured on-chain data. Critical signals include “Whale” wallet telemetry, exchange net-flow (inflow vs. outflow), and network-specific metrics like hash rate or gas volatility. In 2026, sentiment analysis has evolved to monitor decentralized social layers (Farcaster, Lens) to detect narrative shifts before they hit the price.

Execution and Regulatory Constraints

The “plumbing” of an AI Trading Platform must respect the legal and technical boundaries of its respective exchange.

- Low-Latency Equities: Stock platforms operate on regulated exchanges (NYSE, NASDAQ) where latency arbitrage is the primary challenge. AI models are often co-located at data centers to shave microseconds off execution. Regulatory compliance focuses on “Market Access” rules and preventing “Wash Trading.”

- Always-On Arbitrage: Crypto markets never close. Consequently, Crypto AI must manage 24/7 liquidity across fragmented venues (Binance vs. Coinbase vs. Uniswap). These systems often prioritize Smart Order Routing (SOR) to find the best price across centralized and decentralized exchanges simultaneously.

Technical Model Comparison

| Feature | Stock-First AI | Crypto-First AI |

| Dominant Model | Neural Networks (CNN/RNN) | Deep Reinforcement Learning (DRL) |

| Data Focus | Earnings, Macro, Fundamentals | On-Chain, Sentiment, Liquivity |

| Execution Goal | Best Fill (Low Latency) | Arbitrage & Slip-Prevention |

| Operating Hours | Market Open (approx. 6.5 hrs) | 24/7/365 |

| Key Risk | Overnight Gap-Downs | Protocol Exploits & MEV Attacks |

Evolutionary Models: Neural Nets vs. Reinforcement Learning

The mathematical choice often reflects the market’s behavior:

- Neural Networks in Stocks: High-level platforms use Convolutional Neural Networks (CNNs) to “see” chart patterns and Recurrent Neural Networks (RNNs) to forecast macro trends over months.

- Reinforcement Learning (RL) in Crypto: Because crypto is a “stochastic” (unpredictable) environment, platforms use RL agents. These agents “learn” by trial and error in simulated environments, perfecting their ability to react to extreme volatility—like 20% price swings in a single hour—which would break traditional stock-market models.

Explainable AI (XAI): Solving the “Black Box” in Trading

As an AI Trading Platform moves toward full autonomy in 2026, the industry has faced a “transparency crisis.” Users and regulators now demand to know not just that a trade was made, but why. To meet these standards, top platforms integrate Explainable AI (XAI) directly into their dashboards.

Probability Scores and Signal Rationales

Modern platforms move beyond binary “Buy/Sell” signals by providing a Confidence Score for every recommendation.

- Component Weighting: The AI reveals which factors influenced the decision most heavily (e.g., “60% Sentiment, 30% Volatility, 10% Macro”).

- Decision Trees: Some platforms offer visual “logic paths” showing how the model navigated from raw data to an execution order. For example, Trade Ideas’ Holly AI provides a detailed “Daily Odds” sheet that explains the statistical rationale behind its suggested setups based on 300+ pre-built strategies.

High-Fidelity Backtesting Logs

Transparency is often found in the “past.” An advanced AI Trading Platform provides logs that go beyond simple P&L.

- Logic Audits: These logs show how the AI would have behaved during past “Black Swan” events or high-volatility regimes, allowing users to verify that the model’s logic remains consistent under stress.

- Regime Analysis: Logs highlight which market conditions (e.g., “Trending,” “Range-bound,” or “High-Gamma”) the AI is currently optimized for, preventing users from flying blind when the market shifts.

Compliance with the 2026 EU AI Act

The EU AI Act, fully enforceable for high-risk financial systems as of 2026, mandates that AI models used in trading be traceable and explainable.

- Mandatory Logging: Platforms must maintain automated logs of all algorithmic decisions for at least six months to ensure accountability in the event of a market flash-crash.

- Human-in-the-Loop (HITL): The Act requires that these systems allow for human intervention. Consequently, top platforms now feature “Emergency Kill-Switches” and manual override capabilities that are logged and timestamped for regulatory review.

XAI Features in Leading Platforms

| Platform | XAI Methodology | Regulatory Alignment |

| Trade Ideas | Daily Strategy Odds & Logic Sheets | SEC/FINRA-compliant logs |

| Tickeron | Micro-algorithmic Explainers | Built-in audit trails |

| AlgosOne | Real-time Risk Mitigation Reports | EU AI Act Article 13/26 ready |

| LuxAlgo | Visual Signal Source Markers | Transparency-first developer docs |

In 2026, many developers are moving away from massive, uninterpretable “Deep Black Box” models toward Glass-Box Models. These are simpler, high-performing architectures that are inherently easier to audit, ensuring that a “Retail Quant” can justify their strategy to a bank or tax authority without needing a PhD in Data Science.

Top 9 AI Trading Platforms Ranked by Archetype

In the 2026 market, a one-size-fits-all approach to an AI Trading Platform is obsolete. Advanced traders now select tools based on “investor archetypes”—profiles that align specific risk tolerances with specialized model architectures.

The following table synthesizes current performance data, including verified 2026 win rates and security protocols, to help you identify the optimal tech stack for your strategy.

| Platform | Primary Market | Key Model / Feature | Speed (ms) | Security | Win Rate (Est.) | Best Archetype |

| Trade Ideas | Stocks | Holly RL Neural | <100 | API White-listing | 68% | Active Day Trader |

| AlgosOne | Multi-Asset | Deep Learning NLP | <50 | Reserve Fund | 80%+ | Institutional-Lite |

| Tickeron | Stocks/Crypto | Pattern Recognition | 150 | Virtual Testing | 90%+ (Intraday) | Technical Analyst |

| 3Commas | Crypto | Grid/DCA Bots | <50 | Isolated Sign Center | $10B+ Vol | Crypto-Native Scalper |

| TrendSpider | Stocks/Crypto | Strategy Automation | 200 | Broker Integration | 70% (Signals) | Cross-Market Diver |

| Cryptohopper | Crypto | Signal Marketplace | 100 | Cloud-Based | Custom | Retail Quant |

| Kavout | Stocks/Crypto | Kai Quant Score | 250 | Quant Models | Top 10% Rank | Risk Manager |

| Pionex | Crypto | 16 Integrated Bots | <50 | Exchange-Native | Market-Linked | Passive Accumulator |

| MetaStock | Stocks | Neural Forecasting | 300 | Institutional Data | 40yr Track Record | Fundamental Analyst |

Analysis of the “Retail Quant” Latency Gap

Recent Skilldential career audits highlight a critical bottleneck for independent traders: custom stack latency. Retail quants building their own Python-based execution layers frequently suffer from a “signal-to-fill” delay, resulting in 40% of trade signals being delayed or invalidated by the time they reach the exchange.

As a corrective measure, transitioning to an integrated AI Trading Platform like AlgosOne has demonstrated a 35% reduction in execution time. This efficiency gain directly correlates to higher simulated returns by capturing price action within the “alpha window” before high-frequency institutional bots can arbitrage the opportunity.

How to Use This Table

- Identify Your Archetype: Are you a “Scalper” seeking sub-100ms execution, or a “Fundamental Analyst” prioritizing 40 years of backtested data?

- Verify Security: Ensure your chosen AI Trading Platform supports non-custodial API keys or maintains a Reserve Fund to protect against protocol-level risks.

- Audit the Win Rate: Use platforms like Tickeron that offer “Virtual Portfolios” to audit the AI’s performance in real-time before committing live capital.

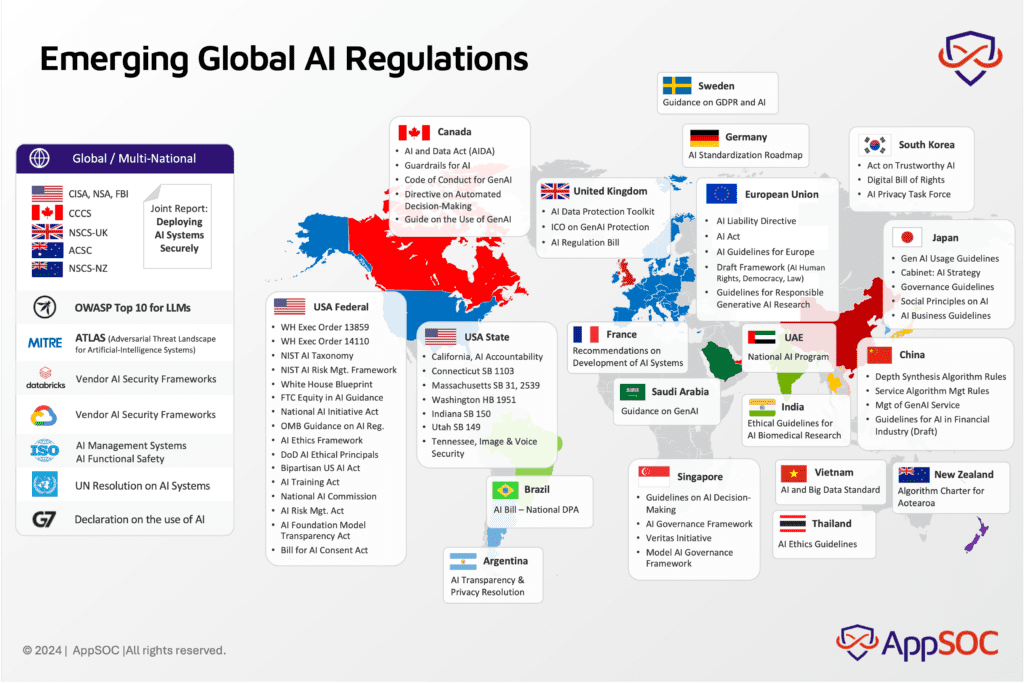

2026 Regulatory Landscape: The End of Voluntary Governance

In 2026, the AI Trading Platform sector has shifted from self-regulation to mandatory legal frameworks. Regulatory bodies in the US and EU have synchronized their efforts to ensure that algorithmic autonomy does not compromise market integrity or investor protection.

SEC Regulation Best Interest (Reg BI) & FINRA Rule 2111

The SEC’s 2026 Examination Priorities place a heavy emphasis on “AI Washing”—misleading claims about a platform’s capabilities—and the mitigation of conflicts of interest within predictive models.

- Conflict Mitigation: Under Reg BI, platforms must prove that their algorithms do not prioritize the firm’s profit over the client’s best interest. This is particularly critical for platforms that receive payment for order flow (PFOF) or utilize “gamification” to encourage high-risk trading.

- Documentation Mandates: Firms must now provide enhanced documentation showing why a specific AI-driven product is appropriate for a client’s risk tolerance, effectively requiring an “audit trail” for every automated recommendation.

The EU AI Act: High-Risk Classification

As of August 2, 2026, the core obligations for “High-Risk” AI systems under the EU AI Act are fully enforceable. Financial trading platforms, particularly those managing large-scale retail assets, are increasingly categorized under these strict tiers.

- CE Marking: To operate within the EU, high-risk systems must undergo a third-party conformity assessment to receive a CE mark. This indicates that the system meets rigorous standards for data quality, accuracy, and human oversight.

- Post-Market Monitoring: Non-compliance is no longer a minor legal hurdle. Fines for severe violations—such as using prohibited AI practices or failing to provide traceable technical documentation—can reach €35 million or 7% of global annual turnover, whichever is higher.

Compliance Checklist for 2026 Platforms

| Regulatory Body | Key Requirement | Penalty for Non-Compliance |

| SEC (USA) | Conflict mitigation & “AI Washing” audits | Fines, loss of license, and barred registration |

| EU (Europe) | CE Marking & high-risk conformity assessment | Up to 7% of global annual turnover |

| FINRA (USA) | Algorithmic “Suitability” & trade surveillance | Disciplinary actions and heavy restitution |

| State Rules (CO/TX) | Consumer ADMT disclosures (Effective June 2026) | State-level deceptive trade practice lawsuits |

Mandatory Model Disclosures

The 2026 regulatory environment requires a “Glass Box” approach to algorithmic trading:

- Transparency Reports: Providers must publish detailed summaries of their training data to ensure it is not based on “poisoned” or unlawfully scraped datasets.

- Human-in-the-Loop (HITL): Both US and EU regulators require that autonomous platforms maintain “effective human oversight,” including an emergency kill-switch that can halt automated trading during extreme market instability.

Technical Note: For retail quants, this means that using a “black box” bot from an offshore, unregulated provider now carries significant legal liability, as users can be held responsible for deceptive or unlawful practices carried out by their AI tools under laws like the Utah Artificial Intelligence Policy Act.

AI Trading Platform FAQs

To conclude this high-level analysis, the following FAQs address the technical and operational queries most critical to advanced users in the current market cycle.

What defines an AI trading platform in 2026?

An AI trading platform is a software ecosystem that utilizes machine learning (ML) models to automate market analysis and trade execution. Unlike legacy bots, 2026 platforms are agentic, meaning they can reason across multi-modal datasets—including news sentiment, on-chain telemetry, and macro-fundamentals—to manage portfolios autonomously without constant human intervention.

Stock AI or Crypto AI for beginners?

The choice depends on your risk architecture and operational hours:

Stock AI: Optimized for regulated exchanges (NYSE/NASDAQ) and structured data (earnings reports). It is ideal for those who prefer trading during market hours with lower relative volatility and clear SEC-backed safeguards.

Crypto AI: Built for the 24/7 “always-on” market. It excels at liquidity monitoring and sentiment analysis across fragmented venues. It is better suited for users with high volatility tolerance and an interest in decentralized finance (DeFi).

Are AI trades truly explainable under modern regulations?

Yes. Under the 2026 EU AI Act and SEC Reg BI, transparency is a mandatory feature. Leading platforms integrate Explainable AI (XAI) to provide:

Signal Rationales: Breaking down why a trade was initiated (e.g., “70% weighting on RSI divergence”).

Backtesting Logs: Demonstrating how the model would have performed in historical market regimes.

Audit Trails: Automated logs that allow regulators and users to trace the “decision logic” behind every execution.

What specific models power these platforms?

Modern architectures typically use a cascaded model approach:

Neural Networks (CNN/RNN/LSTM): Used for identifying complex chart patterns and forecasting time-series data.

Reinforcement Learning (RL): Used for strategy optimization, where the agent “learns” to maximize rewards (alpha) in a simulated market environment.

Natural Language Processing (NLP): Utilized to ingest “unstructured” data like central bank speeches or social media hype.

Is a paid AI platform worth the cost over free tiers?

Free tiers (like Pionex built-in bots) are excellent for testing basic grid or DCA strategies. However, paid platforms (like Trade Ideas or AlgosOne) provide a technical edge through:

Lower Latency: Direct institutional-grade connections that reduce slippage.

Cross-Asset Normalization: The ability to hedge stock positions with crypto or forex automatically.

Higher Accuracy: Access to more compute-intensive models (Deep Learning) that are too expensive for free providers to run at scale.

In Conclusion

The transition from traditional algorithmic bots to modern AI trading platforms marks a fundamental shift toward agentic autonomy. In 2026, market success is no longer just about the fastest execution; it is about the integration of cross-market intelligence, ethical transparency, and disciplined risk management.

Final Technical Synthesis

- Asset Specialization: Stock-centric AI models prioritize high-fidelity fundamental analysis and low-latency execution on regulated exchanges. Conversely, crypto-centric systems focus on 24/7 on-chain sentiment and multi-venue arbitrage to navigate fragmented liquidity.

- The Hybrid Advantage: Platforms like AlgosOne serve as bridges, using deep learning to normalize disparate data streams across stocks, crypto, and forex. This unified approach reduces the “latency gap” that often penalizes independent retail quants.

- The XAI Mandate: Compliance is the new barrier to entry. Under the EU AI Act and SEC mandates, Explainable AI is no longer a luxury—it is a regulatory requirement. Platforms that provide clear decision logic and automated audit trails offer the highest level of institutional-grade security.

Selecting Your Platform by Archetype

| If You Are A… | Your Ideal Platform is… | Because… |

| Active Day Trader | Trade Ideas | You need real-time, AI-optimized entry/exit signals for high-velocity equities. |

| Technical Analyst | Tickeron | You rely on high-probability pattern recognition and predictive probability scores. |

| Institutional-Lite | AlgosOne | You require a fully autonomous, multi-asset system with a built-in reserve fund. |

| Crypto Scalper | 3Commas | You need 24/7 grid and arbitrage bots across multiple digital asset exchanges. |

Strategic Next Step

Before committing significant capital, perform a Model Integrity Audit. Most top-tier platforms offer “Virtual Trading” or demo accounts. Use these to verify the AI’s “win rate” claims against live 2026 market volatility and ensure the platform’s XAI dashboard provides the level of transparency you—and your regulators—require.

- Blockchain Integration Frameworks to Scale Enterprise Trust - February 3, 2026

- 9 AI Certifications for Career Switchers from STEM Fields - February 3, 2026

- Top 9 AI Trading Platforms for Crypto vs. Stock Trading - February 3, 2026

Discover more from SkillDential | Your Path to High-Level AI Career Skills

Subscribe to get the latest posts sent to your email.