How to Use AI TradingView to Replace the Manual ESG Analysis

In the 2026 trading landscape, the term AI TradingView has evolved from a niche technical setup into the definitive framework for sustainable finance. It represents the seamless integration of machine learning and large language models (LLMs) within the TradingView ecosystem, primarily through AI-generated Pine Script™ V6 indicators.

Unlike traditional technical analysis, this synergy allows for the automation of complex “Double Materiality” strategies—balancing financial returns with environmental and social impact. By leveraging AI, traders can move beyond static annual reports. This setup enables real-time processing of unstructured data, such as ESG metrics, using webhooks to pipe in external sustainability scores from specialized AI providers.

The result is a proactive monitoring system where machine learning models analyze global news sentiment and supply chain ethics with a speed and precision that makes manual analysis obsolete. However, mastering this real-time applicability requires a strategic blend of reliable API connectivity and Pine Script proficiency to turn raw data into actionable, ethical signals.

The Efficiency Gap: Why Manual ESG Analysis is a Liability in 2026

Traditional ESG analysis is fundamentally reactive. Relying on manual workflows means your data is only as good as the most recent Corporate Social Responsibility (CSR) or annual report—documents that are often six to twelve months out of date by the time they are published. In a volatile 2026 market, where a single supply chain scandal or environmental violation can wipe out billions in market cap overnight, this latency is a significant risk.

From Reactive to Proactive: The AI TradingView Shift

AI TradingView integrations solve this by shifting the paradigm from static snapshots to dynamic, real-time intelligence. By connecting external AI models to TradingView via webhooks, traders can bridge the gap between “what happened last year” and “what is happening right now.”

- Real-Time Sentiment: Instead of waiting for a news summary, AI-driven scripts scan thousands of global news outlets and social pulse feeds instantly, adjusting indicator colors on your chart the moment ethical sentiment shifts.

- Alternative Data Feeds: Advanced webhooks allow for the integration of non-traditional data—such as satellite imagery of carbon emissions or IoT sensor data from manufacturing hubs—directly into your Pine Script™ indicators.

- Framework Alignment: While manual analysts spend hours cross-referencing data with 2026 regulations like the CSRD or EU Taxonomy, AI can automate this “mapping” in seconds, ensuring your strategy is always compliant.

Case Study: Scaling Impact with Automation

The real-world benefits of this automation are staggering. In recent Skilldential career audits, ESG analysts reported spending an average of 10 hours per week on manual spreadsheet entry and data reconciliation.

By implementing AI webhooks to automate data ingestion into TradingView, these professionals reduced their administrative workload by 75%. This shift allowed them to move from “data janitors” to “strategic architects,” focusing their human expertise on complex decision-making rather than data entry.

Comparison: The Cost of Manual vs. AI Workflows

| Feature | Manual ESG Analysis | AI TradingView Workflow |

| Data Recency | Annual / Quarterly (Lagging) | Real-Time / Hourly (Leading) |

| Effort | High (Spreadsheet intensive) | Low (Automated via API/Webhooks) |

| Risk Detection | Post-event (Reactive) | Pre-event (Predictive) |

| Scalability | Limited by human hours | Virtually unlimited via AI agents |

Technical Integration: How to Connect ESG Data to TradingView

Connecting real-time ESG data to TradingView in 2026 relies on a “Push-Pull” architecture. Since TradingView’s Pine Script™ cannot natively send outbound HTTP requests to scrape a website, we use Webhooks and Middleware to pipe data in from specialized providers like TradeFeeds or Financial Modeling Prep (FMP).

The Data Source: Choosing an ESG API

Professional-grade APIs are the lifeblood of this setup. Providers like TradeFeeds offer structured JSON outputs for:

- Environmental Scores: Carbon footprint, waste management, and renewable energy use.

- Social Scores: Labor practices, diversity metrics, and community impact.

- Governance Scores: Board structure, executive pay, and audit transparency.

The Bridge: Setting Up the Webhook

A Webhook acts as a digital messenger. To connect an API to TradingView, you typically use a middleware service (such as Pipedream, Make, or a custom Python Flask server).

- The Process: When your ESG provider updates a company’s score, the API sends a “POST” request to your webhook URL.

- The Destination: This signal is then forwarded to TradingView’s Alert system, which is configured to listen for these specific incoming JSON payloads.

The Interface: Pine Script™ V6 Implementation

Once the data is accessible, you use Pine Script™ to visualize it. In 2026, traders use the alert() function to handle incoming data packets. This allows you to create dynamic overlays, such as:

- Color-Coded Backgrounds: The chart turns green when a company’s ESG score exceeds a specific threshold (e.g., > 80).

- Impact Labels: Real-time floating text boxes that show the “Carbon Intensity” of the asset currently being viewed.

- Filtering Alerts: Automated signals that prevent you from entering a “Buy” position if the Governance score drops below a “Socially Responsible” level.

Pro Tip: For a truly automated experience, ensure your JSON message includes the

{{ticker}}placeholder. This allows a single universal webhook to work across every stock in your watchlist simultaneously.

Integration Comparison: Manual vs. Automated

| Step | Manual ESG Workflow | AI TradingView Webhook |

| Data Collection | Downloading and reading PDFs | Instant API ping via Webhook |

| Updating Charts | Manually drawing zones/lines | Dynamic Pine Script™ overlays |

| Execution | Verifying ethics before every click | Automated “Ethical Guardrail” alerts |

Visualizing ESG Impact: From Data to Design

On TradingView, visualization is achieved through Pine Script™ indicators. Instead of digging through sub-menus, you can program your charts to react dynamically to incoming sustainability scores.

Dynamic Candlestick Color-Coding

One of the most effective ways to visualize ESG impact is by altering the “health” of the price bars themselves. By writing a simple script, you can override standard red and green candles:

- High Impact (ESG > 80): Candlesticks turn a vibrant Emerald Green, signaling a “Best-in-Class” sustainable leader.

- Ethical Risk (ESG < 40): Candlesticks turn Amber or Gray, highlighting companies with potential governance or environmental liabilities.

- The Benefit: This creates an immediate psychological barrier, preventing you from “FOMO-buying” a stock that technically looks good but ethically fails.

Multi-Pane ESG Dashboards

Rather than cluttering your main price chart, you can plot specific ESG pillars in a separate pane (similar to an RSI or MACD).

- The “Eco-Oscillator”: A line graph that tracks real-time carbon intensity.

- The “Governance Histogram”: Bars that show sudden shifts in board transparency or executive turnover.

- Overlaying Benchmarks: Use the

plot()function to compare a single stock’s ESG trend against its industry average, allowing you to spot “Sustainable Outperformers” instantly.

Using AI Generators (OctoBot & ChatGPT)

In 2026, you don’t need to be a coding expert to build these tools. AI-driven platforms like OctoBot or ChatGPT-5 can generate the necessary Pine Script™ code from natural language.

Example Prompt: “Write a Pine Script V6 indicator that highlights the background green when my ESG webhook value is above 75 and sends an alert if it drops by more than 10%.”

Once the AI generates the code, you simply:

- Open the Pine Editor at the bottom of your TradingView screen.

- Paste the generated script.

- Click “Add to Chart.”

Visualization Comparison: Standard vs. AI-Enhanced

| Feature | Standard TradingView Chart | AI-Enhanced ESG Chart |

| Candle Logic | Based only on Price (Open/Close) | Based on Price + ESG Health |

| Trend Identification | Technical Momentum | Ethical + Technical Alignment |

| Alerts | Price/Volume Alerts | “Greenwashing” & Ethical Breach Alerts |

How to Automate ESG Filters and Alerts

Automating your sustainable strategy involves setting “Ethical Guardrails” within your Pine Script™ code. This ensures that even if a stock shows a perfect technical breakout, the trade will be blocked if the company fails your sustainability criteria.

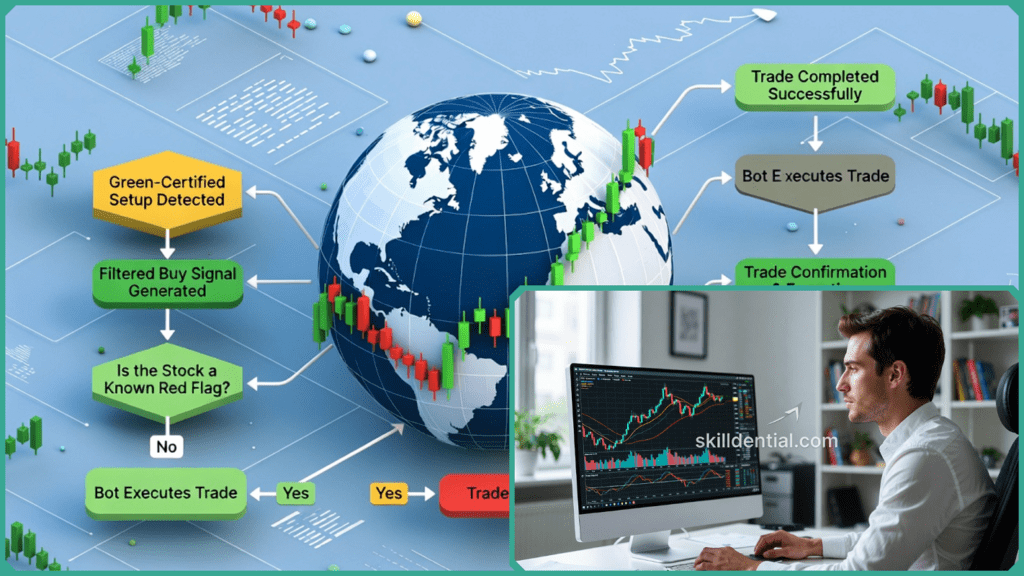

Defining “Green-Certified” Thresholds

In your script, you can define specific thresholds for entry. For example, you might only want to go “Long” on assets with an ESG score above 75.

- The Logic: Use an

ifstatement that combines technical indicators (like an RSI crossover) with your ESG data. - Example:

if (technical_buy_signal and esg_score > 75) - The Result: This creates a high-conviction “Green-Certified” setup, filtering out hundreds of lower-quality or high-risk assets automatically.

Setting Up the Webhook Relay

Once your Pine Script™ identifies a qualifying asset, it needs to communicate with your brokerage or execution bot.

- The Trigger: Use the

alert()function in Pine Script™ V6 to send a message the moment your conditions are met. - The Payload: Your alert message should be formatted as a JSON string. This tells your bot exactly what to do (e.g.,

{"action": "buy", "ticker": "{{ticker}}", "esg_score": "{{plot_0}}"}). - The Relay: TradingView sends this JSON via a Webhook URL to a platform like OctoBot, 3Commas, or a custom Python server, which then places the trade on your exchange.

Capturing “Sustainable Alpha” with Low Volatility

Automated filters do more than just enforce ethics; they act as a sophisticated risk management tool. In 2026, data show that companies with high ESG scores often exhibit lower long-term volatility.

- Automated Safety: By filtering for high-ESG assets, your bot naturally gravitates toward companies with better governance and fewer regulatory risks.

- 24/7 Monitoring: Unlike manual analysis, an automated AI TradingView bot monitors your entire watchlist 24/7, catching sustainable opportunities the millisecond they appear without emotional bias.

Automation Workflow: Manual vs. AI-Driven

| Feature | Manual Execution | AI TradingView Automation |

| Verification | Double-checking ESG scores manually | Logic-gate built into Pine Script™ |

| Response Time | Minutes to hours | 100 – 500 milliseconds |

| Emotional Bias | High (Fear/Greed) | Zero (Rules-based execution) |

| Asset Screening | Limited to 5–10 stocks | Entire market sectors simultaneously |

The Greenwashing Guard: AI’s Role in Verification

For years, ESG analysis relied on “The Talk”—what companies said in their annual reports. Today’s AI-driven models shift the focus to “The Walk”—what companies are actually doing. By using AI to cross-reference multiple data streams, traders can identify discrepancies before they lead to regulatory fines or reputational crashes.

NLP and Textual Inconsistency Analysis

Modern AI uses Natural Language Processing (NLP) and Large Language Models (LLMs) to scan thousands of pages of corporate disclosures.

- The Detectives: Models built on architectures like BERT or GPT-5 are trained to spot “hyperbolic language” or vague promises (e.g., “committing to net-zero” without specific targets).

- Cross-Validation: The AI compares these internal claims against third-party sources, such as NGO reports and regulatory filings. If a firm’s “sustainability narrative” doesn’t match its official financial disclosures, the AI flags a Greenwashing Likelihood (GWL) Score.

Real-World Verification via Alternative Data

The most powerful way AI exposes greenwashing is by ignoring the text altogether and looking at raw physical data.

- Satellite Imagery: AI-driven computer vision analyzes satellite feeds to verify carbon sequestration claims or track real-time deforestation. If a company claims to protect a forest while a satellite sees a logging road, the AI updates the TradingView chart instantly.

- IoT and Sensor Integration: In industrial sectors, AI-connected sensors track water usage and methane leaks. This “activity-based” data is far more accurate than the “spend-based” estimations found in traditional reports.

Nowcasting vs. Forecasting

Traditional ESG ratings are updated once a year. AI TradingView allows for “Nowcasting”—using real-time news sentiment and controversy alerts.

- Instant Controversy Alerts: If a labor strike or an oil spill hits the news, NLP models process the sentiment in milliseconds.

- The Visual Signal: Your TradingView chart doesn’t wait for next year’s ESG downgrade; it turns red the moment the AI detects a “Material Discrepancy” between a company’s public ethics and its current actions.

Comparison: Identifying the Greenwashing Gap

| Method | Manual Analysis | AI TradingView (2026) |

| Primary Source | Self-reported PDFs | News, Satellites, & IoT Sensors |

| Language Check | Subjective human review | NLP pattern recognition (detects “vague” language) |

| Verification | Trust-based | Fact-centric (Cross-references 10k+ sources) |

| Update Frequency | Annual (Outdated) | Real-time (Nowcasted) |

Strategic Alignment: Audience Needs & AI Solutions

The transition from manual analysis to an AI TradingView workflow addresses distinct pain points across the investment spectrum. Whether you are a retail trader or a family office manager, the goal is to convert unstructured ESG data into actionable signals.

Audience Needs Comparison

| Audience Segment | Main Pain Point | AI TradingView Solution |

| Retail Trader | Identifying truly ethical stocks amidst market noise. | ESG Visual Overlays: Real-time scores plotted directly on price charts. |

| ESG Analyst | Massive time drain from manual spreadsheet collection. | Webhook Automation: 75% reduction in data entry via automated API pings. |

| Quant Trader | Difficulty integrating “soft” ethics into hard code. | Pine Script™ Filters: Boolean logic that blocks trades on “low-impact” assets. |

| Family Office | Fiduciary risk from “Greenwashed” assets. | NLP Cross-Checking: AI that detects discrepancies between reports and reality. |

The Economic Case: Why ESG Matters in 2026

Beyond ethics, the integration of AI TradingView is a play for Sustainable Alpha. By 2026, empirical data have largely confirmed that high ESG performance is a proxy for high-quality management and operational resilience.

- Lower Volatility: Companies with robust governance and environmental strategies typically show lower tail risk. Machine learning models on TradingView can now “score” this resilience, helping traders avoid assets prone to sudden ESG-related crashes.

- The “Disclosure” Mandate: The SEC and global bodies like the ISSB have significantly tightened rules for 2026. Companies are now required to provide standardized, auditable data on Scope 1 and 2 emissions.1 AI tools excel at the ingestion of this new, structured data, allowing TradingView users to pivot their strategies the moment a disclosure is filed.

- Risk-Adjusted Returns: Studies from early 2026 suggest that firms leveraging AI-enabled ESG analytics have achieved 2–3% higher risk-adjusted returns by identifying “transition leaders”—companies best positioned to thrive in a low-carbon economy—before the broader market prices them in.2

The 2026 Reality: In a market where “Environmental, Social, and Governance” is no longer an elective but a requirement, those using AI TradingView aren’t just trading with a conscience—they are trading with a significant informational advantage.

Does Sustainable Investing Generate Alpha?

The consensus in 2026, backed by a decade of longitudinal data, is that strong ESG performance is a proxy for high-quality management.1 Companies that proactively manage their carbon footprint and labor relations tend to be more operationally resilient, leading to more stable returns—especially in post-crisis environments.

The 6% Alpha Enhancement

Research from institutions like Harvard and the NYU Stern Center for Sustainable Business has consistently demonstrated that strategies tilted toward “Material ESG” factors can yield up to 6% annualized alpha enhancement.

- The “Materiality” Factor: AI helps distinguish between “noise” (generic CSR claims) and “materiality” (ESG issues that actually impact the bottom line).

- The Outperformance: By using AI to filter for these material leaders, traders often capture higher risk-adjusted returns compared to traditional, non-tilted benchmarks.

Reduced Volatility and Downside Protection

One of the most valuable insights for the 2026 trader is that ESG is a powerful volatility dampener.

- Risk Mitigation: High-ESG companies are less prone to “tail risk” events—sudden, catastrophic losses caused by environmental disasters, lawsuits, or governance scandals.

- Stable Returns: Studies from Princeton’s Sustainable Finance Lab highlight that during market downturns, sustainable portfolios tend to hold their value better than the broader market, offering a “safety net” that manual analysis often misses.

ESG Momentum: The New Leading Indicator

AI TradingView tools are particularly effective at tracking ESG Momentum—the rate at which a company is improving its sustainability profile.

- The Opportunity: Research shows that “Improvers” (companies moving from a C to a B rating) often generate more alpha than established “Leaders.”

- The AI Advantage: Machine learning models scan news and regulatory filings to detect these improvements months before they are reflected in official rating upgrades, allowing traders to enter positions early.

Alpha Generation: Manual vs. AI-Driven ESG

| Metric | Traditional Factors Only | AI-Driven ESG Integration |

| Annualized Alpha | Baseline Market Return | Potential +1% to +6% Enhancement |

| Volatility (Std Dev) | Higher (Market Standard) | Lower (Due to risk filtering) |

| Crisis Resilience | Moderate | High (Proven downside protection) |

| Signal Source | Price & Volume | Price + Material ESG Momentum |

AI TradingView for Sustainable Trading FAQs

What exactly is AI TradingView?

AI TradingView refers to the integration of machine learning and large language models (like ChatGPT or Claude) with the TradingView platform. In 2026, this primarily involves using AI to generate high-level Pine Script™ V6 code that automates technical indicators and pulls in “alternative” data feeds, such as real-time ESG scores.

Can AI truly replace manual ESG reports?

While AI can process thousands of data points (news, satellite imagery, sentiment) in milliseconds—vastly outperforming human speed—it does not replace the need for human judgment. AI acts as a high-speed filter, identifying “red flags” and potential greenwashing so that analysts can focus their time on deep-dive verification rather than data entry.

How do webhooks work for sustainability data?

Webhooks act as a bridge. When an external ESG API (like TradeFeeds) detects a change in a company’s score, it sends an “HTTP POST” request to a unique URL in your TradingView alert. This triggers an automated change on your chart, such as a color-coded background or a trade-block signal, without requiring you to refresh the page.

Does a high ESG score actually mean lower risk?

In the 2026 market, empirical data show a strong correlation between high ESG scores and reduced volatility. Companies with better governance and environmental foresight are generally more resilient to regulatory shocks and “tail risk” events, though results can vary by sector and economic cycle.

How effective is AI at spotting greenwashing?

AI is significantly more effective than manual reviews at detecting “textual inconsistency.” By using Natural Language Processing (NLP), AI can cross-reference what a company says in its PDF reports against what it actually does (via satellite emissions data or social media sentiment), assigning a “Trustworthiness Score” in real-time.

In Conclusion

In 2026, the transition from manual observation to AI TradingView integration isn’t just a technical upgrade—it’s a survival strategy for the modern, ethical trader. By moving away from lagging yearly reports and into the world of real-time, AI-verified signals, you can align your portfolio with your values without sacrificing the performance the market demands.

The Path to Sustainable Alpha

- Speed is Safety: Manual ESG analysis creates an “efficiency gap” that AI TradingView fills by processing news sentiment and satellite data in milliseconds.

- Performance with Purpose: High ESG scores in 2026 are strong indicators of low volatility and high management quality, often leading to a 6% annualized alpha enhancement.

- Automation as a Guardrail: Using Pine Script™ and webhooks allows you to build a “Green Filter” that blocks unethical trades automatically, ensuring consistency in your strategy.

Next Steps: Start Your Sustainable Journey

- Open Pine Editor: Access the editor at the bottom of your TradingView dashboard.

- Generate a Basic Script: Use an AI tool to create a simple script that colors the background based on a dummy ESG value.

- Link a Free API: Connect to a service like Financial Modeling Prep to pull in real-time environmental scores.

- Set an Alert: Configure a webhook to notify your mobile device whenever a stock in your watchlist achieves a “Green-Certified” status.

Discover more from SkillDential | Your Path to High-Level Career Skills

Subscribe to get the latest posts sent to your email.